Find present value

Calculate the present value of 38000 to be received after 9 years if the current rate of interest is 56 per year. Present value is the value of money right now today.

Zui Aj4mnizbam

1 The NPV function in Excel is simply NPV and the full formula.

. If you could earn a 5. Hence the formula to calculate the present value is. Using the Present Value Calculator.

Future Amount The amount youll either receive or would like to have at the end of the period Interest Rate Per Year Discount Rate The annual. The net cash flow would be 19000 from cash inflow minus 13000 from the cash outflow resulting in. For example if a person could delay the expenditure of 10000 for one year and could invest the funds during that year at a 10 interest rate the value of the deferred.

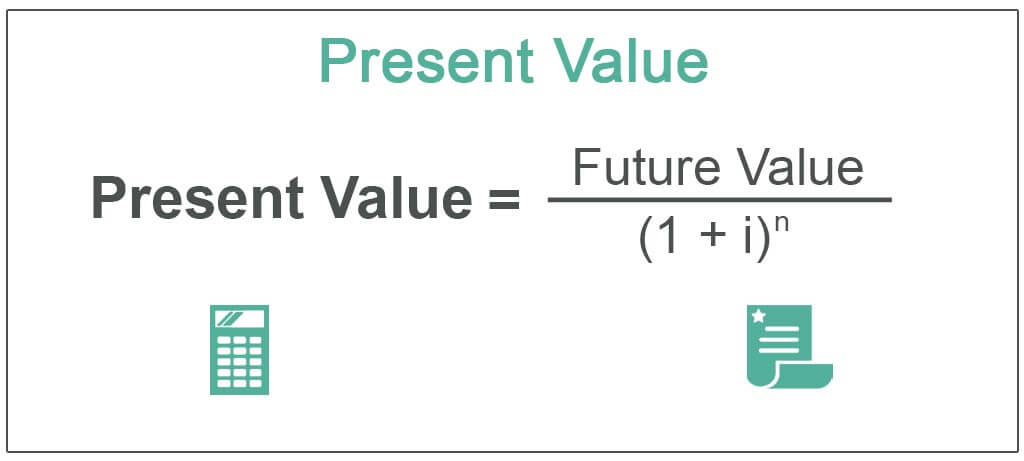

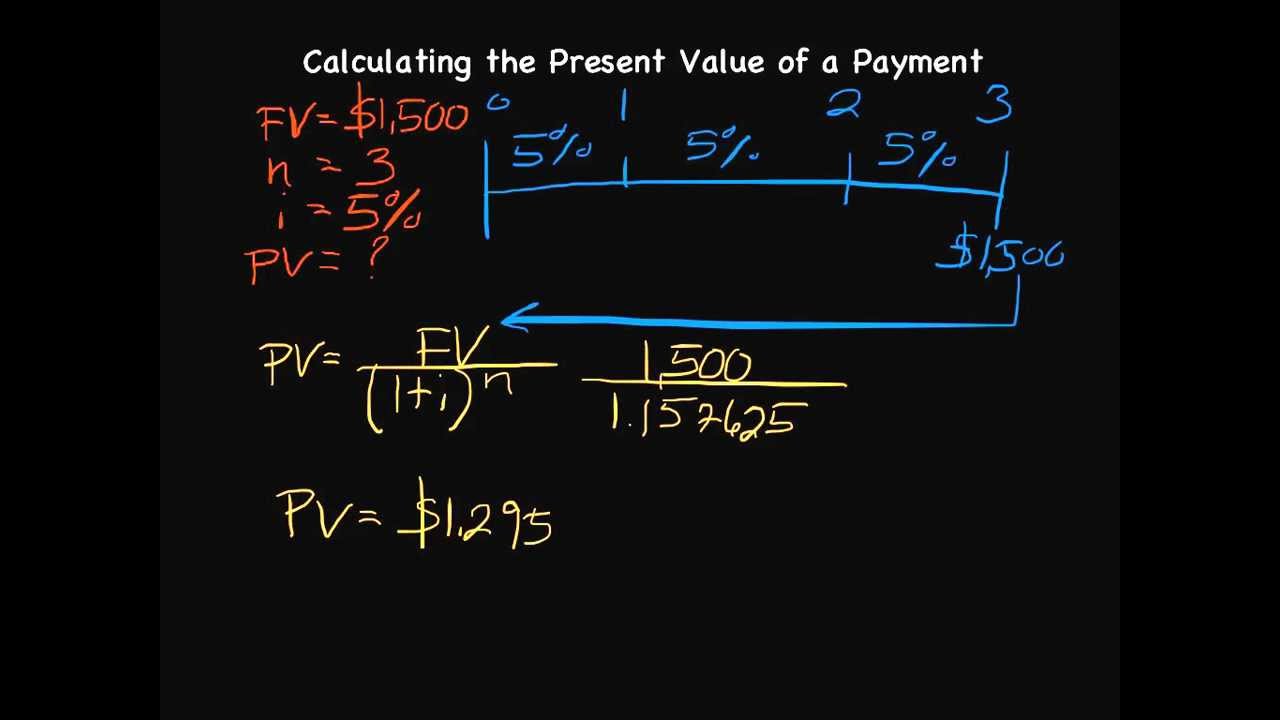

The present value formula PV formula is derived from the compound interest formula. PV FV x 1 1 i t In this formula. Present Value Calculation Example 1.

Calculate the Net Present Value NPV of an investment. First we need to find the present value of future cash flows with a discount rate of 10. Assuming the initial cash flow for a project is 10000 invested for a project and subsequent cash flows for each year for 5.

Here is the formula for present value of a single amount PV which is the exact opposite of future value of a lump sum. Assume that your bank pays 5 interest. Imagine that you want to have 12500 in your bank account exactly 1 year from today.

PV FV 1 r nnt. For example assume you will receive 100 in 5 years. Given a projected or desired future value of money an interest rate and a number of interest periods the present.

A plan that allows employees to donate unused sick-leave time to a charitable pool from which employees who need more sick leave than they are. This problem has been solved. 100 today has a present value of 100 but 100 one year from now is worth slightly less because money loses value over time as prices.

FV the future. In Excel there is a NPV function that can be used to easily calculate net present value of a series of cash flow. How to calculate the net present value of a project.

With those three variables you can use the following formula to calculate the present value. Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at a certain rate. Where PV Present value.

Pv Function Learning Microsoft Excel Excel Templates

Present Value Definition Example Step By Step Guide

Calculating Present And Future Value Of Annuities Annuity Time Value Of Money Annuity Formula

Present Value Pv To Future Value Fv Chart To Find The Best Investment Plan Or To Find The Best Time Value Of Money Chart Time Value Of Money Investing

Calculating Present Value Accountingcoach

Present Value And Future Value Formula For Scientific Calculator Input Scientific Calculator Annuity Lins

Calculating Present Value Of An Annuity Ti 83 84 141 35 Youtube Annuity Calculator Investing

Time Value Of Money Financial Mathematics Icezen Time Value Of Money Accounting And Finance Finance

Loan Payment Formula Loan Credit Agencies Credit Worthiness

How To Calculate Present Value Youtube

Present Value For Simple Interest Youtube

Fixed Deposit Return Comparison Chart To Calculate The Best Time Value Of Money Chart Time Value Of Money Investing

Find Present Value For Future Amount Youtube

Present Value Formula Calculator Examples With Excel Template

Present Value Formula With Calculator

Calculating Present Value Accountingcoach

Common Stock Valuation Through Capitalization Technique Common Stock Forex Candlestick Patterns Capitalization